SLAAKMAN

Posts: 2725

Joined: 7/24/2002

Status: offline

|

quote:

FDR’s 1933 Gold Confiscation was a Bailout of the Federal Reserve Bank

by Daniel Carr, owner/operator of Moonlight Mint and www.DC-Coin.com

President Franklin Delano Roosevelt’s 1933 executive order outlawing the private ownership of gold in the United States was arguably unconstitutional. But why did he do it ? Many historians and economists point to efforts to get the economy moving again as the reason, the theory being that people were hoarding gold and the velocity of money in circulation needed to be sped up.

But the real reason for the gold confiscation was a bailout of the privately-controlled Federal Reserve Bank. And the evidence has been printed right in front of our faces.

PAPER REPLACES SPECIE

During the 1800s, paper money was suspect in the eyes of many. Nobody would ever choose a government-issue $20 note over a $20 gold coin. Gradually during the late 1800s and early 1900s, confidence in government paper money increased to the point where it was widely accepted. People accepted the money because they felt confident they could exchange it at the US Treasury or any Federal Reserve Bank for gold at any time – it even said so on the notes. Without the gold exchange clauses printed directly on the notes, the public would have been much less likely to accept them. Silver Certificates and United States Notes circulated alongside Gold Certificates, which were legally interchangeable dollar-for-dollar.

THE “FED” AND EASY MONEY

In 1913 the Federal Reserve Bank was established and it began issuing Federal Reserve Notes the following year.

Once free of the restrictions imposed by the limitations of available physical gold for coinage, the quantity of Dollars in circulation increased dramatically. The increase was mostly in the form of paper money, not specie.

The result was an economic “boom”, also known as “The Roaring Twenties” (1923-1929). But like all artificially-induced stimulus, it came to a crash in the fall of 1929. The burden of over-extended credit was the culprit. Prior to the formation of the Federal Reserve, money in circulation consisted of copper, silver, and gold coins, United States Notes, Silver Certificates, and Gold Certificates. All of these were non-interest-bearing, were issued directly by the US Treasury, and did not have any debt associated with their issuance.

Notes issued by the Federal Reserve, however, were generally lent out, with interest due. So for every Federal Reserve dollar in circulation, somebody needed that dollar to pay off a debt. During the Roaring Twenties, a lot of people took on debt, resulting in a great credit expansion. When only physical gold and silver was used as money, institutions were very cautious about lending it out because if the debtor defaulted, the creditor would be out some serious (sound) money.

But with the advent of Federal Reserve Notes, the bank was more willing to lend. And with easier qualification terms, people stepped up to the window. The increased willingness to lend was due to the fact that the item being lent out was just a piece of replaceable paper, not a hard-to-get piece of gold. Sure, the notes said “redeemable in gold” (otherwise they might have been refused in commerce). But few members of the public actually exchanged such notes for actual gold. And thus, the Federal Reserve was free to lend almost at will, with little regard for loan losses. When the interest burden of all that new credit began to weigh more-heavily on the general economy, the inevitable credit contraction led to the Stock Market Crash and the Great Depression. Everyone was suddenly reluctant to borrow, banks were reluctant to lend, and the velocity of money in circulation slowed to a crawl.

A GOLD RUN ?

The financial footing of the United States became shaky. European countries which were holding substantial quantities of US gold-clause notes began presenting them to exchange for physical gold. The US Government’s fixed price of gold at $20.67 per troy ounce had been in effect for some time. But as the Great Depression deepened, the free-market price of gold started creeping up above that. This was an indication that confidence in gold-clause notes was starting to wane. A gold run on the Federal Reserve bank was imminent. And that was something that couldn’t be tolerated.

And the reason that a gold run couldn’t be tolerated, is that neither the Federal Reserve nor the US Treasury held anywhere near enough gold to back all the Gold Certificates and Federal Reserve Notes that were in circulation. And printing more of these notes would only erode confidence in them even further. The gold fractional-reserve system was at the end of the road.

GOLD-CLAUSE NOTES

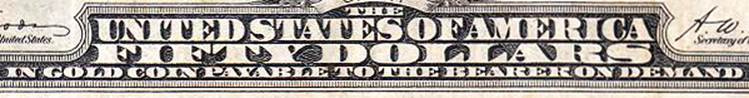

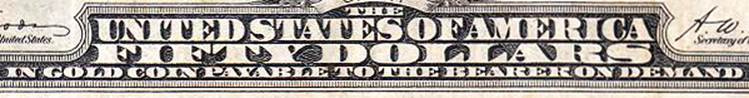

This is a typical gold-exchange clause found on Gold Certificates issued by the US Treasury from about 1905 to 1922.

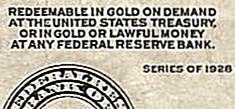

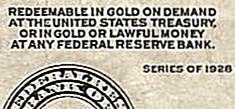

And the clause on series 1928 US Treasury Gold Certificates looked like this:

Series 1914 Federal Reserve Notes carried this gold-clause:

1928 series Federal Reserve Notes were printed with this:

HOW MANY IN CIRCULATION ?

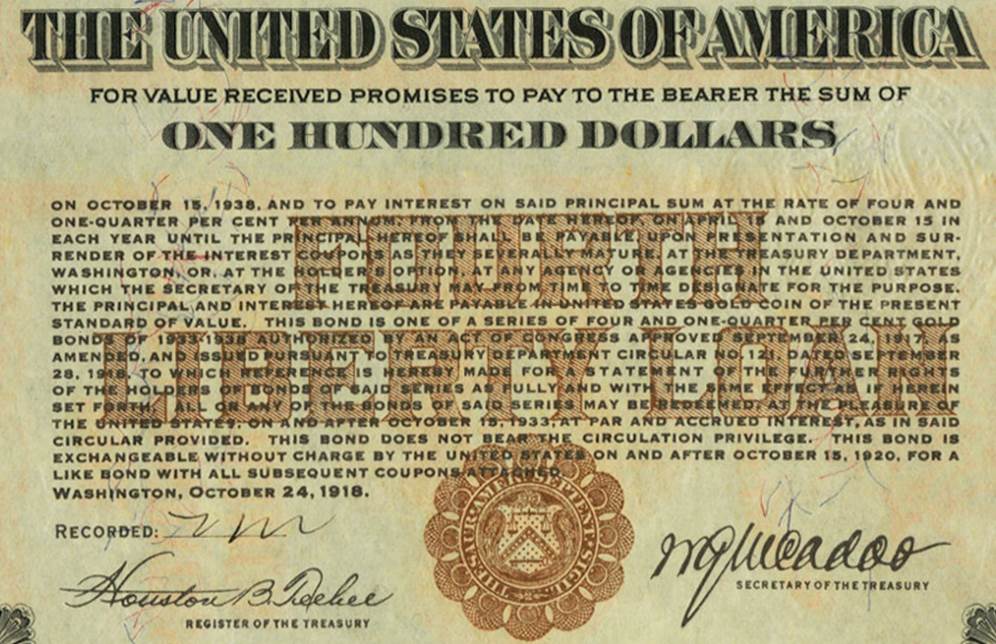

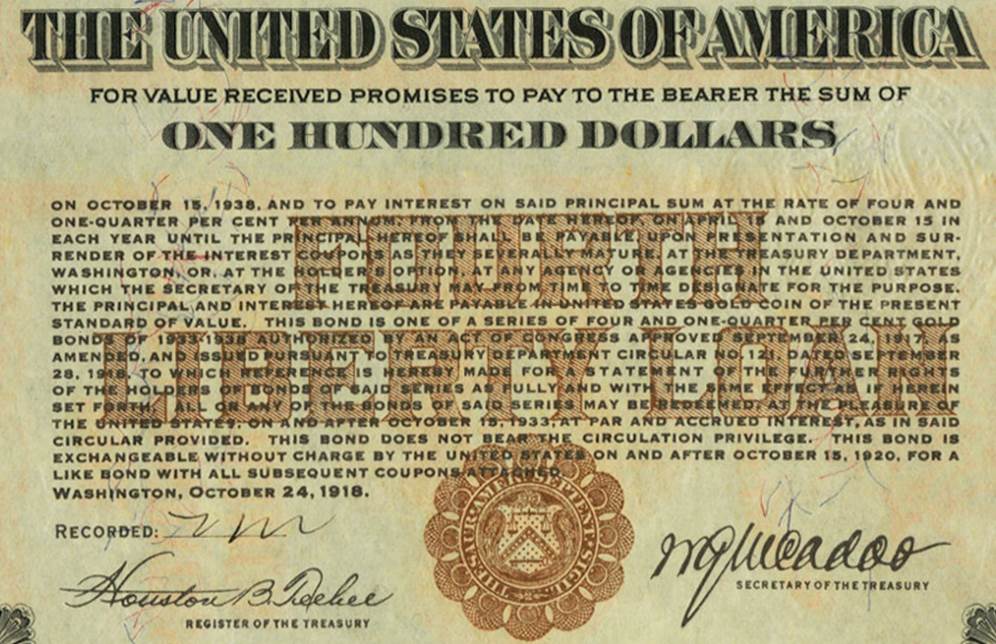

Proof that the Federal Reserve Bank and the US Treasury were in serious trouble, that they didn’t have nearly enough gold to back the notes issued, can be found in the tables in the appendix to this article.

The total numbers of various notes issued are available from a number of sources. The appendix shows data reported in two books: “The Standard Handbook of United States Paper Money”, 6th edition (1977), by Chuck O’Donnell; and “The Comprehensive Catalog of U.S. Paper Money”, 1981 edition, by Gene Hessler.

To calculate the total face value of all gold-clause notes in circulation, it is necessary to know how many were issued, and how many may have still been around in 1933. The appendix tables do not include US Treasury Gold Certificates issued prior to 1905. Quantities of pre-1905 Gold Certificates were relatively small, and most would have been redeemed (and replaced with new notes) before 1933. The number of notes issued is known. The number surviving in 1933 can only be estimated.

According to the US Treasury, the average life span of a current $100 bill in circulation is about 7.5 years. Adjusted for inflation, one-hundred 2011 Dollars is equal to roughly five 1933 Dollars. Five Dollars in 1933 was a fair amount of money. The velocity of money in circulation was much lower then as well, especially during the Great Depression. A person receiving a $5 bill in change in 1933 would be unlikely to wad it up and casually stuff it in their pocket. They would more likely carefully squirrel it away for some other “rainy day”. So in 1933, a typical $5 bill would not get worn out as fast as a 2011 $100 bill. And larger-denomination notes would circulate even less often. Gold-clause notes would likely be the most tightly-held (and least circulated) of all types of notes, followed by Silver Certificates and US Notes (in that order). So it is probably a fair assumption that, on average, the “half-life” of gold-clause notes in circulation would be at least 20 years – meaning that after every 20 years or so, half the notes remaining in circulation would have to be replaced due to being worn out. The majority of gold-clause notes were issued shortly before 1933 during the 1928-1933 period, so they would still be in relatively new condition in 1933.

All this doesn’t account for gold-clause notes that were turned in for physical gold, even though they may have still been in good condition. But if Federal Reserve Notes were turned in while still in good condition, the notes would have simply been placed back into circulation by the Federal Reserve Bank or US Treasury. Many US Treasury Gold Certificates turned in for redemption may have actually been cancelled and not re-released into circulation.

GOLD SHORTFALL

Records indicate that the total gold reserves of the country in 1933 were 4 Billion dollars worth. And at $20.67 per troy ounce, that equates to about 6,000 metric tons of gold.

The total face value of US Treasury Gold Certificates issued from 1905 to 1928 equates to more than 16,000 metric tons of gold. Taking the generous assumption that the US Treasury did not issue more Gold Certificates than they had gold to back them, would mean that only 37.5% of all 1905-1928 Gold Certificates were still outstanding in 1933. In other words, if 37.5% of all Gold Certificates were still outstanding in 1933, the US Treasury would have just enough gold to back them.

Now the real problem is the gold-clause Federal Reserve Notes. Since these were generally re-released upon redemption (if in good condition), the only attrition in the quantity of notes outstanding would be due to replacement of worn-out notes. A conservative estimate of the total number of Federal Reserve Notes still in circulation in 1933 would be at least 75%.

The total face value of gold-clause Federal Reserve Notes issued prior to 1933 was equivalent to nearly 54,000 metric tons of gold. If 75% of them were outstanding in 1933, that would still be 40,500 metric tons of gold that the Federal Reserve Bank (and the US Treasury) didn’t have. Even taking the extremely low estimate of only 37.5% of the Federal Reserve Notes remaining, that would still be over 20,000 metric tons of gold. With US gold reserves at 6,000 tons, this would be a shortfall of 14,000 tons. But those 6,000 tons were needed to cover the US Treasury Gold Certificates. So at the very minimum, Federal Reserve Notes to the tune of 20,000 metric tons of gold were “circulating naked” in 1933.

THE BAILOUT

So along comes FDR. One of the very first things he did was issue an executive order basically outlawing the private ownership of gold bullion. US Treasury Gold Certificates were no longer legal tender when held by the general public, unless exchanged at the US Treasury or Federal Reserve Bank for other non-gold paper. The US Treasury could then transfer 6,000 metric tons of gold to the Federal Reserve as a token backing for the “full faith and credit of the United States”. Reportedly, the US Treasury sent gold certificates to the Federal Reserve in exchange for Federal Reserve Notes. So the net result of this exchange was that the privately-controlled Federal Reserve Bank held US Treasury Gold Certificates backed by US Treasury gold, while the US Treasury held Federal Reserve Notes backed by “credit”. These actions bailed out the privately-controlled Federal Reserve bank, which as of 1933 would no longer be in danger of collapsing due to a sort-fall of 20,000 or more metric tons of gold.

During a “Fireside Chat” on 07 May 1933, Roosevelt basically admitted that gold-clause obligations far exceeded the amount of gold held by the US Treasury and Federal Reserve. In fact, the total gold obligations far exceeded the amount of gold in the entire world, not even counting corporate gold obligations.

“Behind government currency we have, in addition to the promise to pay, a reserve of gold and a small reserve of silver, neither of them anything like the total amount of the currency.” – FDR, 07 May 1933.

In the same speech, Roosevelt outlined that the total US gold reserves amounted to between 3 and 4 billion dollars worth (4,500-6,000 metric tons), and that all the gold in all the world was valued at 11 billion dollars (16,500 metric tons). At the same time, Roosevelt admits that US Government (and Federal Reserve) gold obligations were at least 30 billion dollars worth (45,000 metric tons), and that private US corporations had promised another 60 billion dollars worth (90,000 metric tons).

Roosevelt’s 07 May 1933 Fireside Chat (the important part of the audio starts at 15:30). NOTE: I have searched the internet and all posted transcripts of the speech are missing the key phrase “neither of them anything like the total amount of the currency”. But that statement is clearly heard in the audio.

As citizens complied with the new ”law” by turning in gold, the gold reserves of the US Treasury and Federal Reserve increased. After most of the public’s gold was turned in, FDR raised the official price from $20.67 to $35.00 per troy ounce. How “convenient”. Gold-clause Federal Reserve notes were not recalled and remained in circulation. But they could no longer be exchanged for gold, except by certain foreign central banks. Those with connections were able to buy valuable assets with mere paper. Wealth was concentrated in fewer hands.

The new series of 1934 Federal Reserve notes no longer had any gold clause, they were only redeemable for “lawful money”, whatever that was.

THE FALLOUT

FDR’s actions in bailing out the Federal Reserve Bank set in motion the ultimate debt-enslavement of the US Government and its citizens.

(CONT)

http://www.moonlightmint.com/bailout.htm

_____________________________

Germany's unforgivable crime before the Second World War was her attempt to extricate her economy from the world's trading system and to create her own exchange mechanism which would deny world finance its opportunity to profit.

— Winston Churchill

|

Printable Version

Printable Version

New Messages

New Messages No New Messages

No New Messages Hot Topic w/ New Messages

Hot Topic w/ New Messages Hot Topic w/o New Messages

Hot Topic w/o New Messages Locked w/ New Messages

Locked w/ New Messages Locked w/o New Messages

Locked w/o New Messages Post New Thread

Post New Thread